EIR Publishes Article 'How Should the BRICS Respond to Trump's Crypto-Tariffs?'

There are three predictable outcomes of Trump’s aggressive crypto-tariff policy. I use the phrase “crypto-tariff” advisedly, because the imposition of sky-high tariffs left and right, especially on targeted BRICS countries, goes hand in hand with the frenzied expansion of cryptocurrencies to bail out the $2 quadrillion speculative bubble that is like a giant cancer in the trans-Atlantic financial system. The imposition of tariffs will loot the physical economies of the Global South and force huge flows of funds to the financial centers of the West (Wall Street and the City of London); and the crypto explosion is meant to prop up the unpayable financial bubble of those same centers. Note that the intellectual author of both policies is reportedly the current U.S. Secretary of Commerce, Howard Lutnick, who headed the leading financial services firm Cantor Fitzgerald from 1990 to 2025. Cantor Fitzgerald is a major player in the crypto craze, and manages the reserve assets of Tether, by far the largest crypto stablecoin.

The three foreseeable results are:

1) There are going to be involuntary defaults and moratoria on foreign debt payments by multiple countries in the Global South, because there will be sharp drops in their exports to the U.S. and other countries, and therefore their export revenues, as a result of the tariffs. The 20 BRICS countries (10 member and 10 partner nations) have a combined foreign debt of about $6 trillion—which is one important fuse, of many, that could ignite the $2 quadrillion financial bomb. With the wave of sovereign defaults, debtor countries will be pressured to accept agreements with the IMF, which will try to impose its hated austerity conditionalities. Victim nations will have to choose between going down with Wall Street and the City of London Titanic, or pursuing options independent of that Titanic, such as China’s Belt and Road Initiative and the collective approach of the BRICS. Expect major global realignments as a result.

2) The Global South will start to significantly reorient its trade flows, increasing exports to countries that do not impose tariffs on it, and importing from other countries in the Global South and Global East which are also victims of the crypto-tariffs. Intra-BRICS trade will be particularly favored. We will see tectonic shifts in these physical international trade flows in the coming months and years, as profound as those seen in the process of global de-dollarization since the start of the war in Ukraine. One example of such a tectonic shift is the importation of oil by India (which relies on imports for 87% of its domestic consumption): prior to 2022, less than 1% of India’s oil imports came from Russia; by June 2025, the Russian share had risen to over 43%.

3) There is going to be a hyperinflationary explosion in the U.S. (and Europe), partly because of the impact of tariffs on consumer prices in the U.S., but more fundamentally because of the expected $100 trillion or so surge in cryptocurrencies between now and 2030, which many “experts” project will result from the policies adopted by the Trump administration.

With those three processes already underway, that leaves two crucial pending questions about how the world will respond to that emerging financial reality:

(A) Will the Global Majority nations finally make the decisions required to establish new institutions for the issuance of large amounts of productive credit, protected from the speculation of the dollar system? What will be the nature and scope of the New Investment Platforms (NIP) that Russian President Vladimir Putin has proposed? What will be the role of the BRICS New Development Bank? In what currency will the new productive credit be issued? In short, will the Global Majority finally adopt a Hamiltonian credit system to replace the current bankrupt trans-Atlantic monetarist system?

(B) Will the countries of the Global North, such as the U.S., recognize that their self-interest as nations lies in cooperating with the BRICS, with the Global South, with the Belt and Road Initiative, for mutual benefit? Will they do so in time to avoid a thermonuclear war against Russia and China? Will the U.S. return to its own policy origins and once again adopt a Hamiltonian credit system to replace the current bankrupt monetarist system?

Fortunately, the answers to questions (A) and (B) above are not mutually exclusive or contradictory: there is a solution to the current crisis that is beneficial for both the North and the South. In fact, (A) is not possible without (B), and (B) is not possible without (A). A new international security and development architecture with those characteristics is both necessary and possible, as Helga Zepp-LaRouche has long argued.

To put the matter another way: If money were wealth, the law of the jungle (a zero-sum game) would in fact be scientifically correct, as the monetarists argue: my gain is your loss. Entropy prevails, and war is a certain outcome. But money is not wealth. True wealth comes from advances in the productive powers of labor as a result of man’s creativity, as Lyndon LaRouche proved, and for that reason the law of the jungle is scientifically false. We actually live in a universe that is not a zero-sum game, a world in which everyone can win. Anti-entropy prevails.

That is both the good news, and the task before us. We next turn to elaborate on the above points.

Sovereign Debt Defaults

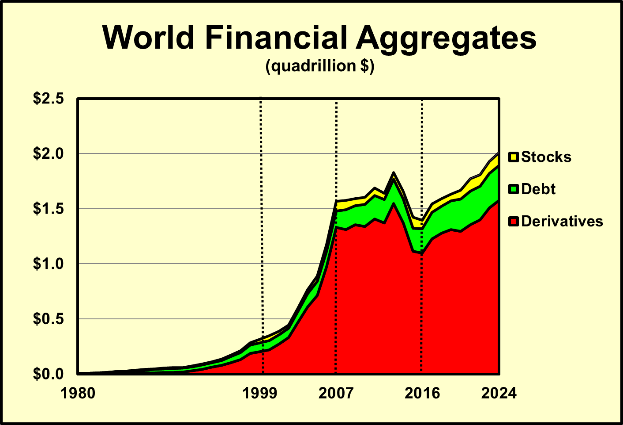

Total global financial aggregates today total over $2 quadrillion. As Fig. 1 indicates, the lion’s share of that is financial derivatives, which EIR estimates rose to about $1.575 quadrillion at the end of 2024. The component of total world debt of all kinds was about $318 trillion and, within that category, total developing sector foreign debt was about $8.8 trillion.

The BRICS 20 nations accounted for about $5.0 trillion (56%) of that total. If we leave aside China’s $2.4 trillion foreign debt, which is arguably distinct from all the others, that leaves “only” $2.6 trillion in foreign debt of the other BRICS 20 nations.

It would be a mistake, however, to believe that the danger is minimal, since this $2.6 trillion is minuscule (a bit over 0.1%) compared to total global financial aggregates of $2 quadrillion. Actually, that $2.6 trillion functions as a fuse capable of igniting the entire $2 quadrillion explosive charge. In 2023, the developing sector as a whole had to pay $1.4 trillion in debt service payments (both interest and principal) on its debt of $8.8 trillion, of which $406 billion was interest payments. This was a shocking 30% increase over the amount of interest paid in 2022—in part due to soaring interest rates.

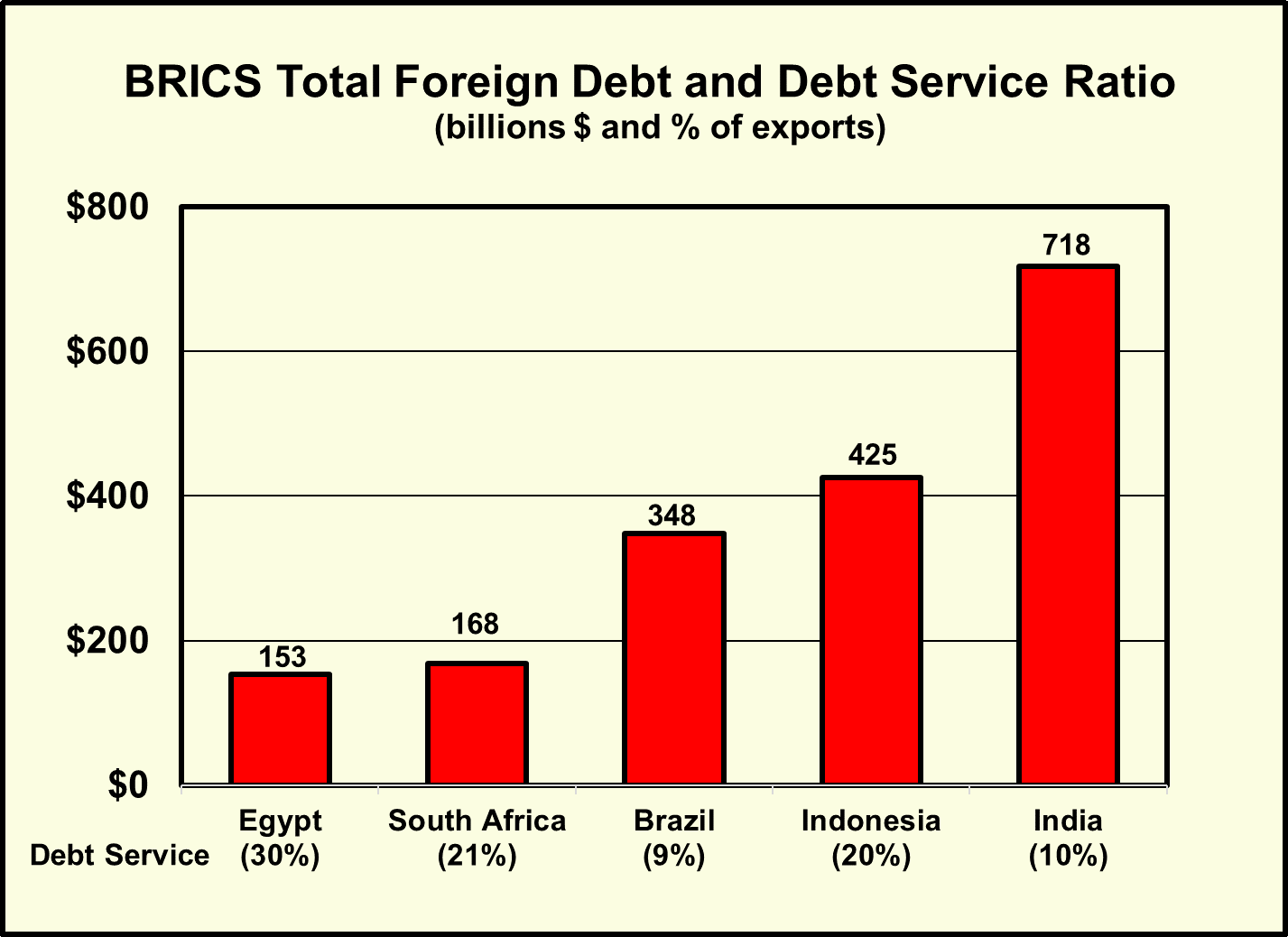

Fig. 2 shows the total debt and debt service payments (as a percentage of exports) of five select, representative BRICS countries. As can be seen, that debt service ratio climbs as high as 30% in the case of Egypt. This indicates an extreme vulnerability to default, as reductions of export earnings—as will unquestionably occur as a result of the Trump tariffs—will cut into the ability to service the debt.

Shifting Trade Patterns

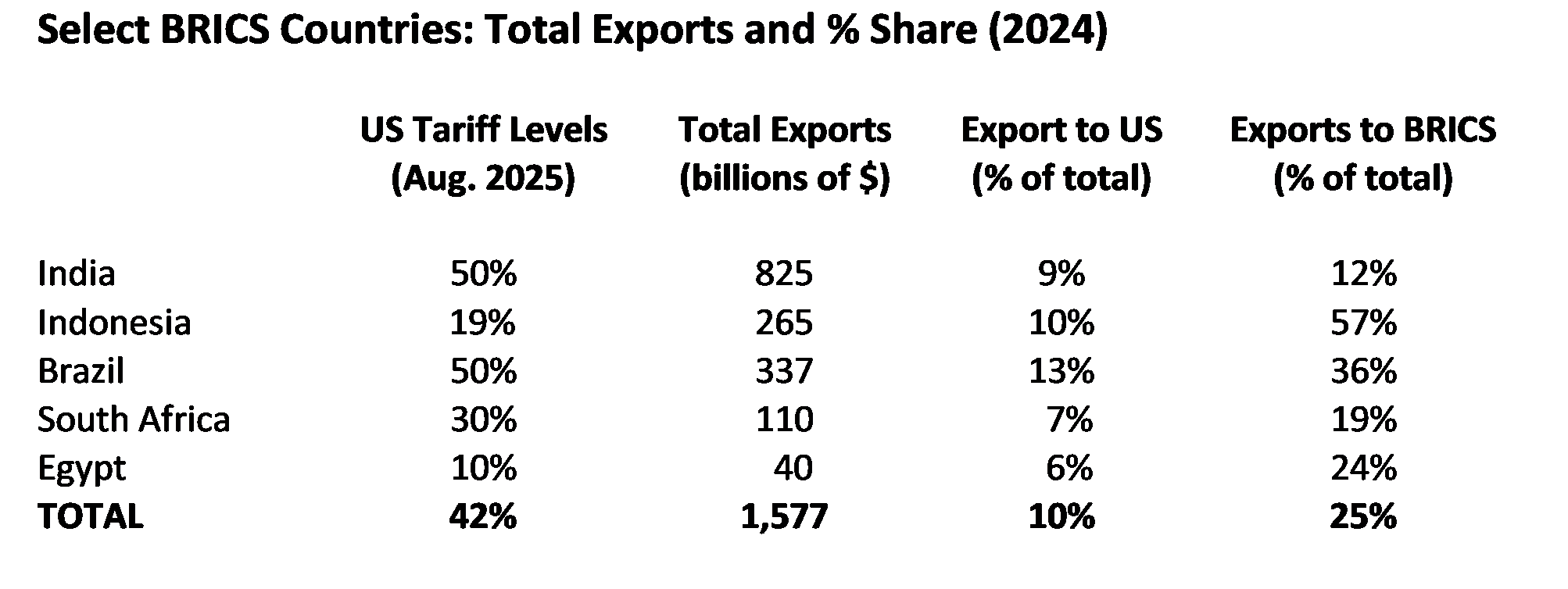

Fig. 3 shows the U.S. tariff levels being applied (as of August 2025) to each of the indicated five BRICS nations, which range up to 50%, which is the case for India and Brazil—which together owe over $1 trillion in foreign debt. The table also shows the share of each country’s exports going to the U.S., as compared to its exports shipped to other BRICS nations. In all cases, those five nations export substantially more to other BRICS nations than they do to the U.S. The weighted average of all five is: 10% of their exports goes to the U.S. (where they face a weighted average tariff of a stunning 42%); 25% of their exports goes intra-BRICS.

Moreover, that spread has been widening over recent years, and it can be expected to do so at an accelerating rate as the Trump tariffs take hold. This also explains why there is growing discussion in the BRICS about forming a BRICS customs union, which would have uniformly low (or zero) tariffs intra-BRICS, with higher coordinated external tariffs outside the BRICS customs union.

None of this should come as a surprise. Today’s ten BRICS member states accounted for only 11% of total world exports back in 2001; today they account for about 25% of the world total.

But it is not only BRICS exports which will be radically shifting. Imports of products which are critical to each nation’s physical economy can be matters of life and death if they are cut off, and detailed studies and intense scrutiny of those specifics are now underway in most, if not all, BRICS nations. They are asking themselves questions such as:

What happens if we are subjected to full economic warfare and embargoes, like Russia, Iran, Venezuela, Nicaragua, Cuba and others have seen? How do we batten down the hatches if we are forced to adopt the equivalent of a war economy, as Russia had to do? These nations are looking at their national bill of materials for survival under conditions of such economic warfare. Are we self-sufficient in food and energy? If not, where can we buy grain and oil? What about steel, cement, fertilizer, tractors, and all-important machine tools and other high-tech capital goods? Who will help us build high-speed railroads, ports and dams? What can we gear up to produce ourselves over the next 5-10 years? Who else in the BRICS or other friendly nations can we rely on for help, technology transfer, and win-win trade?

Hyperinflation

It’s no secret that the Trump tariffs will translate into reduced U.S. imports, combined with the transfer of a large part (if not all) of the increased price of the remaining imported items onto the backs of U.S. consumers. But that will only be a minor component of coming sharp increases in prices, which will happen principally as a result of financial asset inflation unleashed by the planned flooding of the international financial system with some $100-200 trillion in worthless cryptocurrency over the next five years, as is widely forecast.

It is this crypto feature which also puts the lie to the oft-repeated mantra—a favorite of Donald Trump’s economic team—that tariffs will not only bring billions of dollars in revenue to the U.S. Treasury, but they will also lead to a rejuvenation of American industry, as the U.S. shifts to produce domestically what is now being imported.

Those who believe and retail this argument are either fools or liars—or both. First, there are many things that the U.S. is simply physically incapable of producing at this point, thanks to a half-century of aggressive deindustrialization policies at the hands of Wall Street and the City of London. We can’t build high-speed rail. We no longer produce machine tools at the needed scale. Our skilled labor force is aging and dying off. And on and on.

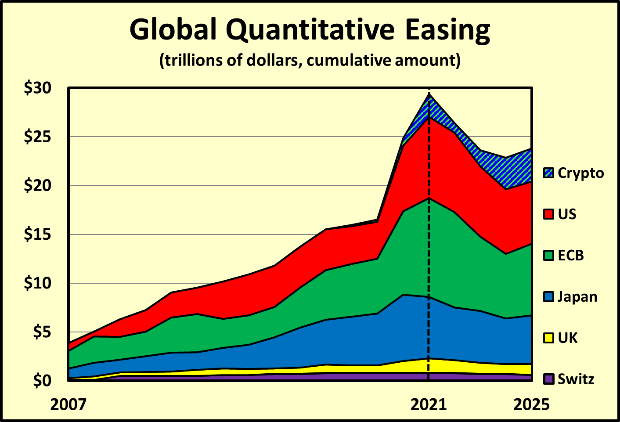

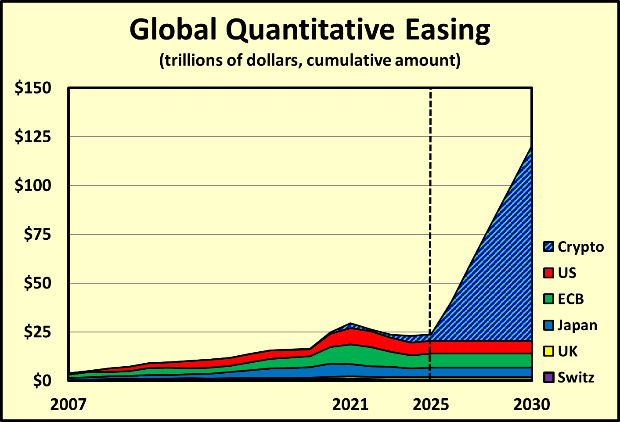

From a policy standpoint, the only way tariffs can help lead to industrialization is if they are coupled with a policy of massive productive credit generation—as was the case with Alexander Hamilton’s design of the American System. But there is no such credit policy in the U.S. today—exactly the opposite is the case. Of the $27 trillion in cumulative Quantitative Easing (QE) pumped into the trans-Atlantic system between 2008 and 2021, supposedly to stop the 2008 financial meltdown by providing fresh funds to banks so they could lend, exactly zero ($0.00) was used for productive investment. It all went to try to bail out the $2 quadrillion speculative bubble.

As Fig. 4 shows, QE had pretty much run its course as of about 2021, and an urgent financier-led drive was launched to pump new trillions of funny-money into the system, in the form of worthless, privately issued cryptocurrency (including so-called stablecoins)—up to $100 or even $200 trillion in new monetary assets by the year 2030, according to a number of sources, as Fig. 5 shows.

This will again be channeled entirely to feed the speculative bubble and further inflate it, with zero deployed for increasing physical economic productivity. Hence, hyperinflation. To think that this approach will solve our economic crisis is like loading a giant financial bazooka with $100 trillion, pouring concrete down its barrel so it can’t possibly go to productive investment, and then firing away.

Today’s promoters of crypto-tariffs are no smarter than Wile E. Coyote.

The LaRouche Action Plan

It is a distinct possibility that Washington’s crypto-tariff policy will backfire in ways that its proponents never imagined. Celso Amorim, the top international adviser to Brazilian President Lula da Silva, stated matter-of-factly that if Brazil can’t sell to the U.S., it will see if other markets, such as China, are available. President Lula himself stated that he would reach out to his Chinese and Indian counterparts, Xi Jinping and Narendra Modi, followed by other leaders. “I’m going to try to discuss with them about how each one is doing in this situation, what the implications are for each country, so we can make a decision…. There is no coordination among the BRICS yet, but there will be.”

The Indian government is also not amused by the 50% tariff placed on their exports to the U.S. That country’s Ministry of External Affairs warned: “It is therefore extremely unfortunate that the U.S. should choose to impose additional tariffs on India.… India will take all actions necessary to protect its national interests.” And there are further extensive discussions underway among the BRICS nations.

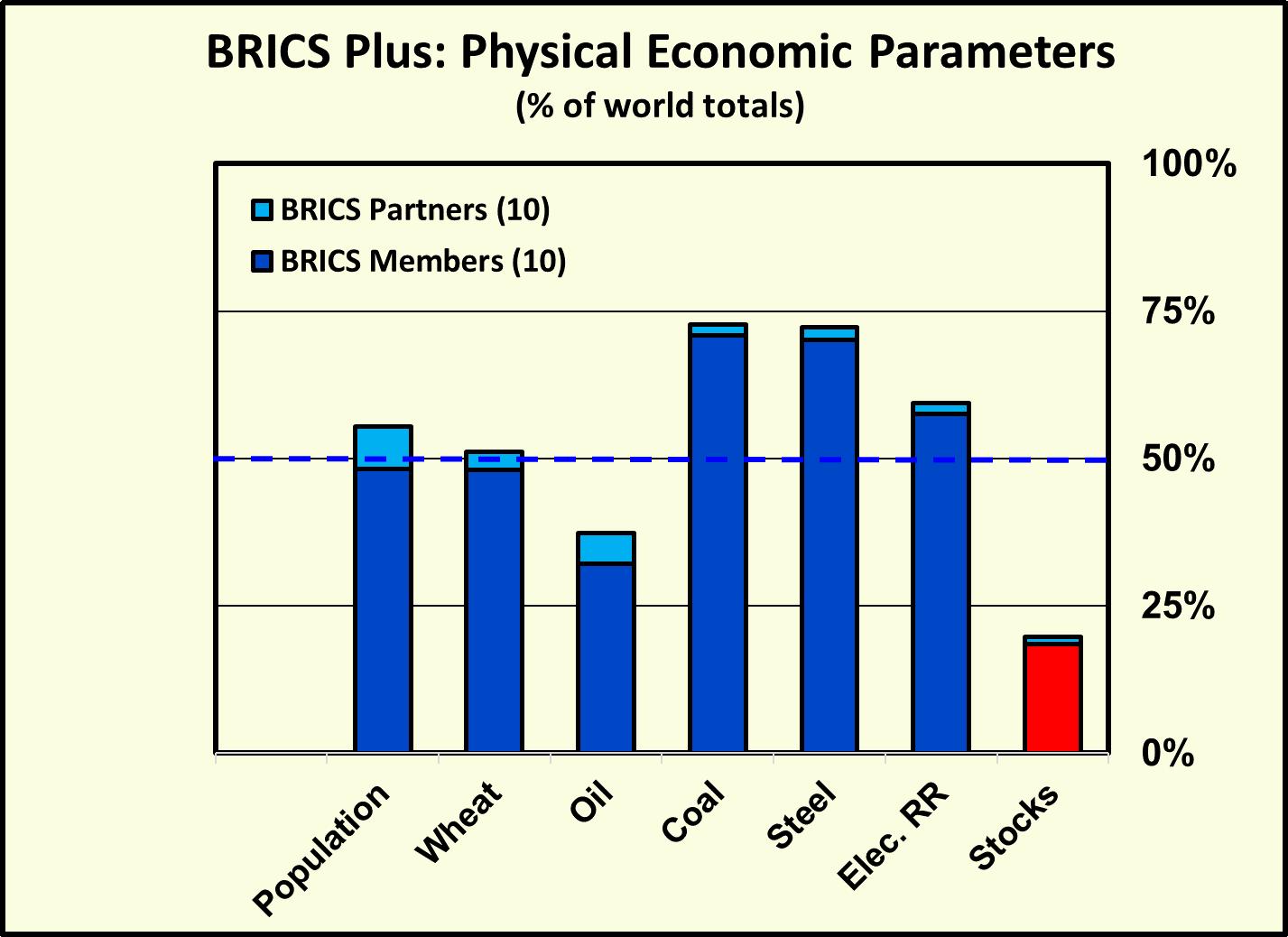

The BRICS 20 nations are well aware of the fact that they together represent 54% of the world’s population, and that they are strong—taken together—in other key physical economic parameters: 52% of global wheat production; 38% of oil; and nearly 75% of coal and steel (see Fig. 6). They are also aware that they can trade with each other using their own national currencies, rather than the toxic, speculation-ridden dollar, and they are increasingly doing just that. And they are studying technical mechanisms for establishing a unified clearing house and settlements system for their non-dollar trade.

The crucial, missing element—to date—is how to create new credit-issuing institutions that can provide massive flows of productive credit, while keeping those flows fully segregated from the $2 quadrillion speculative cancer. A new common unit of account or currency is needed as the vehicle for such credit flows, but this in no way replaces the proper ongoing role of the sovereign national currencies of the participating nations. In other words, the model of what needs to be done is emphatically not that of the European Union’s euro. As this author previously wrote in a 2023 article “Some LaRouche Essentials for Transition to a New International Financial System:”

There are three, central criteria that the new system and its currency must meet:

1) Total separation between the new currency and participating national currencies, on the one side, and the predatory, toxic dollar on the other, i.e., no free convertibility between them. Exchange and capital controls become essential tools to achieve that result. For the United States, this means a return to Glass-Steagall, with its strict separation between productive credit and speculative activity.

2) A fixed exchange-rate relationship between and among those participating national currencies and the new currency. Floating exchange rates have been a tool of financial speculation since August 1971, and they are anathema to long-term trade and investment cooperation among sovereign nations.

3) Productive credit must be issued in that new currency to finance great development projects, with a heavy emphasis on science and advanced technologies, in and among participating nations, to quickly boost the physical economies and thereby provide the only possible solid backing for the value and stability of the new currency. Think Alexander Hamilton.

Those fundamentals still apply today, as the Global Majority deliberates over Putin’s New Investment Platforms and the needed role of the BRICS New Development Bank.

Finally, statesmen of the BRICS nations and the Global Majority must actively appeal to the United States and Europe, especially to their more thoughtful political leaders and movements, to join this win-win approach, and help make it clear that cooperation, not confrontation, is the best option for all parties involved. Crypto-tariffs may be the order of the day in Washington, but the voice of Alexander Hamilton—and of Lincoln, and FDR, and Lyndon LaRouche—has by no means been silenced, as the United States approaches its 250th anniversary.

Origin: https://eir.news/2025/08/news/how-should-the-brics-respond-to-trumps-crypto-tariffs/